In this digital age, millennials have become one of the largest consumer groups, with a unique set of money habits shaped by technological advancements and equipped with a vast array of digital tools and resources at our fingertips to help us stay on top of our finances .

Discover the 15 ways technology is changing how millennials manage their money and how these habits shape the future of personal finance.

The Rise of Digital Banking

The rise of digital banking has revolutionized the way we handle our finances. With just a few taps on our smartphones, we can now transfer money, pay bills, and track expenses in real time. This convenience has made it easier for millennials to stay on top of their finances without visiting a bank physically.

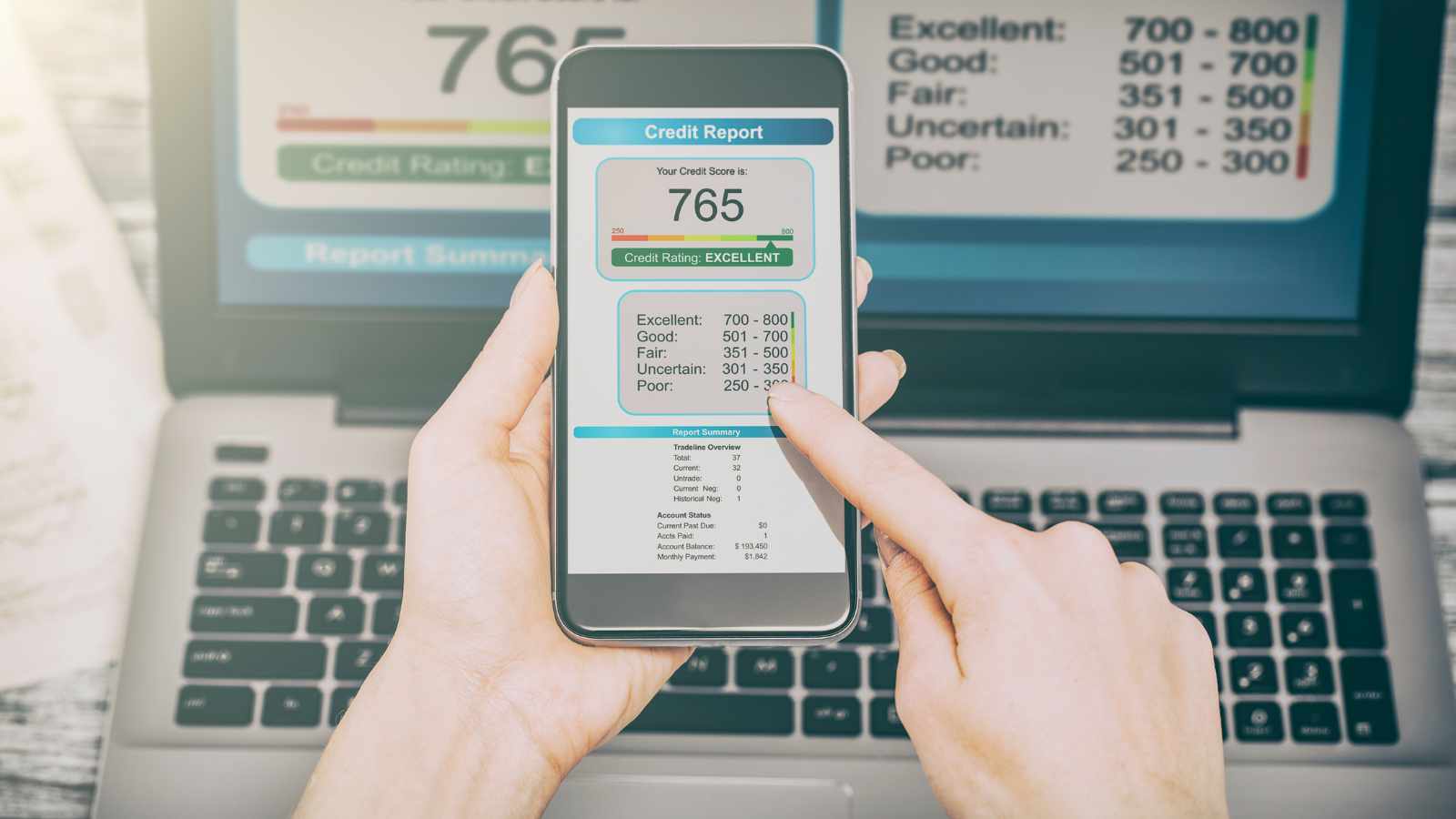

Financial Apps

Another significant impact of technology on millennial money habits is the availability of financial apps. These apps offer personalized budgeting tools, expense tracking, and financial advice tailored to our spending patterns, making it easier than ever to stay within budget. With the help of these apps, millennials can create a more accurate and realistic view of their finances.

The Rise of Contactless Payments

The rise of contactless payments has transformed how we make transactions. We no longer have to carry cash or even bring out our wallets, as we can now make purchases using our smartphones or other contactless payment methods.

Social Media Influence

Social media significantly influences millennial spending habits, with influencers and advertisements constantly bombarding us with products and services. While this may lead to impulsive purchases, technology also provides tools for budget management and saving goals, helping millennials stay financially responsible.

The Emergence of Cryptocurrency

With the emergence of cryptocurrency, millennials have more options for investing and managing their wealth. With easy access through digital platforms, cryptocurrencies offer a decentralized way of storing and transferring funds, giving millennials greater control over their assets.

Automation of Finances

Thanks to technology, millennials can now automate their finances. From setting up automatic bill payments to scheduling investments, automation has made it easier for us to manage our money without constantly monitoring our accounts.

Access to Financial Education

Technology has also made financial education more accessible than ever before. With online resources, webinars, and apps, millennials can learn about budgeting, investing, and other financial topics at their convenience.

Online Shopping

Online shopping has become the go-to for many millennials, with the added convenience of shopping anywhere, anytime. However, this also means greater temptation to overspend. To combat this, technology offers budgeting and tracking tools to help us stay within our means.

Real-Time Data and Analytics

Gone are the days of waiting for monthly bank statements to track expenses. With real-time data and analytics available through banking apps and financial management tools, millennials can now see their spending habits in detail, making it easier to identify areas for improvement.

Improved Security

Technology has also improved the security of our finances. With biometric authentication and two-factor verification features, millennials can feel more secure when making transactions online, reducing the risk of fraud.

Paperless Statements and Receipts

With environmental concerns rising, technology has made it easier to go paperless with financial statements and receipts. These paperless receipts reduce clutter and help millennials keep a more accurate record of their finances.

Access to Investment Opportunities

With the rise of robo-advisors and online investment platforms, millennials have easier access to many investment opportunities. This access opens up possibilities for building wealth and achieving financial goals.

Remote Work and Freelancing

Technology has significantly changed how millennials work, with more opportunities for remote work and freelancing. This change allows millennials more control over their income and finances, making it easier to achieve financial independence.

More From Inspired by Insiders

Not every money you earn must come from a job requiring you to be physically present. You can build wealth passively without the need to be constantly working. Here are ten surprisingly easy ways you can make wealth while you sleep.

10 Stupid Easy Ways to Make Money While You Sleep

15 Things to Never Buy on Amazon

Amazon is a great place to shop, but not everything here is a good deal. We have curated this list of 15 things that are better off your list when shopping on Amazon.

15 Things to Never Buy on Amazon

28 Baby Boomer Slangs Every Millennial Should Know (Or Not!)

With every generation, new words and phrases become trendy while others slowly fade into oblivion. Today, we share some of the most iconic slang from the Baby Boomer era and their meanings.

10 Things to Never Buy at a Thrift Store

Thrift stores offer excellent opportunities to find unique and valuable items at a bargain, but they also can be a source of unwanted items and expensive mistakes. To help you avoid the latter, here are ten things that should never make their way into your home from a thrift store, no matter how low their prices are.

10 Things to Never Buy at a Thrift Store

15 Worst Decisions You’ll Ever Make in Your Life

We all make mistakes in life, but some decisions can have a more significant impact than others, and bad decisions can cost us time, money, and even our self-esteem. This article covers the 15 worst decisions you can make and why you should avoid them.

15 Worst Decisions You’ll Ever Make in Your Life

This article was produced on Inspired by Insiders.